SNB Investments

Estimates Table

In the following table, you can view and download the equity investments of the Swiss National Bank as reported per December 2022. These consist of publicly reported investments and estimates of equity investments where these were not disclosed. For a comprehensive understanding of where the data come from, how the estimates were made or in which companies the SNB does not invest, please read the detailed methodology below the table. This is a Klima Allianz project with support from DataCatering. For media requests and questions: asti.roesle@klima-allianz.ch

1. Introduction

In this webpage, we report the disclosed equity investments of the Swiss National Bank (SNB) and put forward a methodology for estimating its undisclosed equity holdings. The SNB holds equity with an approximate value of \(212.5\) bn. USD.[1]. The available data on SNB’s investments is heavily dependent on the geographical location of these investments. Across nations and continents, institutional investors and fund managers are not obliged to disclose in which companies they invest in, except in the United States (US) and partly in the United Kingdom (UK). So, in Switzerland and other parts of the world, institutional investors like the SNB are not obliged to disclose any of their investments. Therefore, in principle, we should not be able to know where SNB invests. However, and based on the data and information disclosed in the US and the UK, \(68.8\)% of SNB’s equity portfolio is known in detail[2], while \(31.2\)% of the SNB equity portfolio remains undisclosed, which corresponds to roughly \(66.4\) Bn USD. Despite this lack of transparency, it is possible to estimate the undisclosed part of SNB’s equity portfolio. This is because the SNB invests passively by tracking broad market indices, see Weights in ‘MSCI World’.

In the procedure section, we detail the steps with which we estimated the SNB investment portfolio and found out how much, for example, of the national bank’s investment money goes into investments in fossil fuels companies such as TotalEnergies. We then provide an overview of the background data we use to develop these estimates. In the SNB’s investment exclusions section, we list and source all the exclusion criteria followed by SNB. We then dedicate section 5 and 6 to reviewing the estimates and providing potential sources of error. Finally, we conclude the document with a working example.

2. Procedure

For the estimation detailed in this methodology paper, we use as a reference the world market index of industrialized countries, MSCI World, see WEIGHTS IN “iShares MSCI World ETF” and Exclusion of futures on stock indices. Subsequently, for the known investments of the SNB (see Known equity investments of the SNB), we calculate the real weight in the SNB Portfolio per Security, as the one given by Refinitiv reflects only the 68.8% reported. We then calculate the ratio between the weight in the SNB equity portfolio and the weight in the world market index “MSCI World” (if listed there).

Next step, we take the average of these ratios which is \(0.93\) according to the filings on Dec 31st, 2022.

In order to estimate the undisclosed SNB investments, we multiply the average ratio by the weight of the undisclosed companies in the world market index, MSCI World. The product of this multiplication gives us an estimate of the percentage weight of the undisclosed companies in the SNB equity portfolio. In a final step, we multiply the estimated percentage weight of the undisclosed companies by the total value of SNB’s investments in equities as of Dec 31, 2022. The product is an estimate of SNB’s investment in the company which we previously had no information about.

3. The Data

The data we use to estimate SNB’s undisclosed investments and on which we apply the methodology detailed in this document is split into weights in MSCI World which we obtained from iShares MSCI World ETF, and SNB’s known investments in equity obtained from the financial database Refinitiv. The weights and SNB’s investments are per Dec 31, 2022. We choose this data based on SNB’s publication of its equity-share in its foreign exchange reserves (published every quarter) as well as last filings of disclosed investments.

3.1. Weights in MSCI World

The SNB communicates the following regarding the management of its shares:

“Equities are managed on a purely passive basis, whereby broad market indices of advanced and emerging economies are replicated. Exchange rate and interest rate risks are managed using derivative instruments such as interest rate swaps, interest rate futures, forward foreign exchange transactions and foreign exchange options. In addition, futures on equity indices are used to manage the equity investments.[3]

Combined with the information on which currencies the SNB invests in (see Currency Allocation of the SNB Foreign Exchange Reserves), it can be concluded that the SNB mainly tracks the MSCI World or comparable indices of so-called industrialized countries. Due to a lack of data on the exact composition of MSCI World as of December 31, 2022, the weights were taken from the corresponding ETF of BlackRock’s subsidiary iShares, iShares MSCI World ETF.

3.2. Known equity investments of the SNB

Due to the reporting requirements by the U.S. Securities and Exchange Commission, and UK’s Company House, roughly \(68.8\)% of SNB’s total equity investments are known, (SEC; document 13F)[4]. What is known is the number of shares held by the SNB in the respective companies, their value at a given point in time[5] and the percentage of the total SNB portfolio. The latter is central to the present estimation because this value is used to calculate the ratio between MSCI World weighting and SNB portfolio. However, since it is calculated by Refinitiv, this stated value only refers to the percentage share of SNB equity investments in a single company in the known part of the total SNB equity portfolio. Because this known part comprises around \(68.8\)% of the total SNB equity investments, the values calculated by Refinitiv must be multiplied by \(0.6874\) to obtain the effective share of SNB equity investments in a single company in the total SNB equity portfolio.

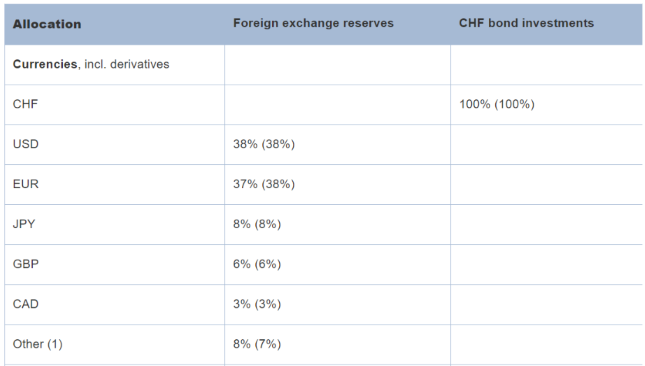

3.3. Currency Allocation of the SNB Foreign Exchange Reserves

The SNB indicates which part of its foreign exchange reserves it invests and in which currencies. It invests the majority of its foreign exchange reserves in the currencies of so-called industrialized countries and the share of so-called emerging markets accounts for only a very small proportion (see Table 1). The latter are shown only as part of the “Other” category, which comprises just 8%.[6] However, since such currencies only account for a small part of this ‘Other’ category[7], it can be assumed that the SNB holds only very few shares traded on stock exchanges in emerging markets[8] (see Investments in companies traded on two stock exchanges (dual listed). It is important to note that the stated currency allocation of the SNB refers to the total foreign exchange reserves including bond holdings. However, because more than two-thirds of the MSCI World or comparable indices are traded in USD, it can be assumed that the SNB also holds most of its equity investments in USD.

Table 1: SNB Investments by Currency.

(1) Mainly AUD, CNY, DKK, KRW, SEK and SGD plus small holdings in additional currencies in the equity portfolios.

4. SNB investment exclusions

The SNB lists a few criteria for companies in which it does not invest. For example, it writes that it deviates from full market coverage in two cases:

“First, owing to its special role as a central bank, the SNB refrains from investing in shares of systemically important banks worldwide. Second, the SNB is committed to respecting Switzerland’s fundamental standards and values in its investment policy. Consequently, it does not invest in either shares or bonds of companies whose products or production processes grossly violate values that are broadly accepted at a societal level.”[11]

Regarding the exclusion of systemically important worldwide, we excluded the list of banks compiled by the Financial Stability Board (FSB) which can be found here. Moreover, we know that the SNB has a broader definition of banks with significant systematic importance, and their exclusion list includes more financial institutions than the thirty banks listed in the published document by FSB. This finding is based on an analysis of U.S. financial institutions, which we know the SNB does not invest in. Therefore, we excluded all financial institutions worldwide, except for insurance companies. With this approach, it is possible that we excluded some companies in which the SNB actually invests in.

The second part of the statement above (“does not invest in either shares or bonds of companies whose products or production processes grossly violate values that are broadly accepted at a societal level”) addresses ESG considerations, and the SNB further explains on its website regarding this:

“SNB does not purchase securities issued by companies that seriously violate fundamental human rights, systematically cause severe environmental damage or are involved in the production of internationally condemned weapons.”[12]

The SNB understands companies that “seriously violate fundamental human rights and systematically cause serious environmental damage” to be:

“The criterion of systematically causing severe environmental damage if they, for example, systematically pollute waterways or the countryside, or seriously damage biodiversity through their production operations.”

And adds that this also includes:

“companies with a business model primarily based on the mining of coal for energy production, as there is a broad consensus in Switzerland in favor of phasing out coal.”

We did not exclude any companies based on ESG considerations because it was either not clear what exactly the SNB meant by this exclusion or the criteria was too weak for any exclusion. Also the analysis of disclosed investments did not show any substantial exclusions based on this criteria.

For the exclusion of companies that are involved in the production of internationally condemned weapons (second part of ESG-based exclusions), we excluded the companies listed in the exclusion list of SVVK-ASIR because SVVK’s criteria are almost identical to those of the SNB and the exclusion list is publicly available here. Based on the SNB’s known investments in U.S. companies, we observed that the SNB uses a broader exclusion list. However, it was not possible for us to track this and subsequently apply it to SNB investments outside of U.S. exchanges. Therefore, it is possible that we have made investment estimates for weapons manufacturers in which the SNB does not invest in.

Finally the SNB’s non-investment in CHF is not an actual exclusion criterion. However, and combined with the exclusion of systemically important banks, these two exclusions have the greatest influence on the SNB’s passive tracking of the world market index of so-called industrialized countries “MSCI World”. Systemically important banks make up \(1\)% of the the MSCI World while Systemically important banks in the broader sense we suspect the SNB uses make up \(5\)% of the same index. Swiss companies make up around \(2.8\)% (as of December 31st, 2022). The other exclusions have much smaller impacts. Arguably Lockheed Martin (\(0.23\)% of MSCI World as of December 31st, 2022) is considered to be one of the biggest exclusions for ESG considerations. In conclusion, we estimate that the SNB excludes about \(10\)% of the companies (weighted) in MSCI World.

5. Review of the Estimates

5.1. Estimates VS Known SNB Investments

Our estimates match the known SNB investment amounts, with an average of \(3.6\)% difference ratio. In other words, when we estimate reported companies using the method here, we find that the estimates deviate \(3.6\)%, on average, from the reported amounts with a sample standard deviation of \(2.5\)%.

5.2. Comparison of the Estimated Total with SNB’s Total Equity Investments

The sum of all estimated equity investments of the SNB comprises around \(192.9\) bn. USD. We then remove the estimated 10% excluded companies from the MSCI World (weighted; see SNB investment exclusions) which is roughly \(19.3\) bn. USD and restore \(7\)% of the total SNB equity investments (\(212.5\) bn. USD) in companies from so called developing economies (see 6.3. Exclusion of Broad Market Indices of Emerging Markets) which is around \(14.8\) bn USD. We further know that the SNB invests in more companies than just those in the MSCI World, even in so-called industrialized countries. This is shown by an analysis of the SNB’s known investments. Although these companies, which are represented in national indices but not in MSCI World, are small investments, they still amount to a considerable sum. For investments in companies headquartered in the U.S. alone, the total is \(8.9\) bn. USD. If we assume that US investments account for about \(65\)% (assumption based on the composition of MSCI World) of the total investments of the SNB, this amounts to an extrapolated estimate of \(13.7\) billion USD. This puts our estimates at \(202.1\) bn. USD and thus \(10.4\) bn. USD too low.

6. Possible sources of error

6.1. Exclusion of futures on stock indices

The SNB writes that “Equities are managed on a purely passive basis”, but it also mentions that, in addition to tracking “broad market indices of industrialized and emerging economies”, it also uses “futures on equity indices”. These could not be considered and probably partly explain why the SNB slightly overweights or underweights individual companies compared to the MSCI World. This overweighting and underweighting can present a source of error in the estimation. However, an examination of the estimated values for known SNB investments (see Estimation with known SNB investments) shows that SNB does not adjust MSCI World weights substantially using futures on equity indices.

6.2. Exclusion of Companies Outside MSCI World

The part of the SNB portfolio for which the investments are known (\(68.8\)%) has significantly more companies than are listed in the MSCI World. This shows that the SNB also invests in companies outside of the MSCI World Index. Some of these are not included in the estimation process and could be a source for errors. However, that part of the known SNB investments in companies that is also part of MSCI World is well over \(90\)% of the known SNB investments.

6.3. Exclusion of Broad Market Indices of Emerging Markets

The SNB invests a very small part of its equity investments in currencies of so-called emerging markets (see Currency Allocation of the SNB Foreign Exchange Reserves). As the world market index of industrialized countries was used as a reference for this estimate (see Weights in ‘MSCI World’), investments in shares of such countries are not included. However, a comparison of the world market index “MSCI World” and the combined index of industrialized and emerging countries “MSCI ACWI”[13] shows that the difference in the weighting of companies from industrialized countries is minimal, especially in the case of higher weighted companies, and in the case of the combined index MSCI ACWI, the share of companies from so-called emerging countries is only \(7\)%.

6.4. Investments in companies traded on two stock exchanges (dual listed)

Some companies choose to trade their shares on multiple stock exchanges. As a result, Russian companies, for example, often traded their shares on the London Stock Exchange until the outbreak of the war. Thus, the SNB, which primarily invests in currencies, can invest in Russian companies[14] without necessarily having to hold them in rubles. For this reason, it is possible that the SNB holds more shares in companies from so-called emerging markets than suggested by the currency allocation (see Currency Allocation of the SNB Foreign Exchange Reserves). However, the different review mechanisms of this estimate (see Review of the estimates) show that this does not result in any substantial deviations.

7. Working Example

Since the SNB is a passive investor and tracks broad market indices, we know that the national bank holds shares in TotalEnergies. SNB is not obliged to disclose investments exchanged outside of the United States and UK. With the methodology laid out above, it is possible to estimate how much money the national bank is investing in a company such as TotalEnergies.

We first obtain the average ratio, \(0.9294\), see Procedure. We multiply this average ratio by TotalEnergies’ weight in MSCI Index as of December 31, 2022.

And

Therefore,

[1] As of 12/31/22; “Total foreign currency reserves (in convertible foreign currencies)” found here; multiplied by proportion of shares in % (849,862*0.25).

[2] 68.8% is the ratio between the sum of all known SNB investments accessible via Refinitiv and the total funds invested by the SNB in equities.

[3] https://www.snb.ch/en/iabout/assets/id/assets_reserves; accessed 17.10.22

[4] In addition to SEC document 13F, there are corresponding reporting requirements in the UK for companies domiciled in the UK. This allows partial insight into SNB investments in UK companies. All other SNB investments are not known. The only exception is Orell Füssli AG, which is one-third owned by the SNB and prints banknotes on its behalf.

[5] The reporting frequency depends on the stock exchange, but is approximately every 3 months.

[6] https://www.snb.ch/de/iabout/assets/id/assets_reserves; the SNB states that only 8% is invested in currencies other than USD, EURO, YEN, BPOUND and Canadian Dollar (all the currencies of industrialized nations). For these 8%, in turn, the SNB also states that they are invested “mainly in AUD, CNY, HKD, DKK, KRW, SEK and SGD” and in addition in “small holdings of other currencies”. From this it is clear that only a very small part can be invested in emerging market currencies.

[7] The only currencies mentioned are Chinese Yuans and South Korean Won, with Australian dollars listed first, for example.

[8] For the definition of which countries are considered developed or emerging markets according to MSCI, see the corresponding MSCI World and MSCI World Emerging Markets factsheets.

[9] As of 6/30/22, the SNB held USD 888 billion in foreign currency reserves. URL: https://data.snb.ch/en/topics/snb/cube/snbimfra; accessed April 1st, 2023

[10] On 6/30/22, the SNB invested 25% of its total foreign currency reserves in equities. URL: https://www.snb.ch/en/iabout/assets/id/assets_reserves; accessed April 1st, 2023

[11] https://www.snb.ch/en/iabout/assets/id/qas_assets_1#t23 ; accessed April 1st, 2023

[12] https://www.snb.ch/en/iabout/assets/id/qas_assets_1#t24 ; accessed April 1st, 2023

[13] https://www.msci.com/documents/10199/a71b65b5-d0ea-4b5c-a709-24b1213bc3c5 accessed April 1st, 2023

[14] https://www.bluewin.ch/de/news/wirtschaft-boerse/snb-hat-bereits-anleihen-mit-russland-bezug-verkauft-1133715.html accessed April 1st, 2023